There are sometimes that you can only see one price but often currency exchange price are display in pairs with 'bid price and ask price'.For example EUR/USD 1.2385/1.2390, 1.2385 is known as the bidding price, while 1.2390 is the asking price. Bidding price is the price that you sell the base currency (EUR in our case here); asking price is the price that you buy the base currency. The different of the bidding and the asking price is called 'spread'.You might notice that bidding price is always lower than the asking price. Ever wonder why? The different of the bid-ask price (socall 'spread') is how currency brokers make profits without charging commissions to their clients (sell high and buy low in the same time.)

Join Free

adsen to content

What's a pip?

A pip is the smallest value in a Forex quote. Take our example earlier on EUR/USD. If the exchange rate goes from 1.2385 to 1.2386; that's one pip. In mathematical definition, a pip means the last decimal place of a quotation.Note that as each currency has its own value, the value of a pip is different from one another. Say USD/JPY rate at 120.75, a pip would be 0.01 (the second decimal place); while for EUR/USD 1.2385, a pip would be 0.0001 (the fourth decimal place).

Trading Forex in MACD: Moving Average Convergence/Divergence

Trading Forex in MACD: Moving Average Convergence/Divergence

MACD uses exponential moving averages (EMA), which are lagging indicators, to include some trend-following characteristics. These lagging indicators are turned into a momentum oscillator by subtracting the longer period of EMA from the shorter period of EMA. Translating the words into mathemathcis, this is how a MACD calculation looks like:MACD = EMA [shorter period] - EMA[longer period]The resulting plot forms a line that oscillates above and below zero (positive when EMA[shorter] > EMA[longer] and negative whenver EMA[shorter] < EMA[longer]), without any upper or lower limits. MACD is a centered oscillator and the guidelines for using centered oscillators apply. Besides the resulting plot, a standard signal line (or some call it trigger line) is added in the MACD graph for the indication. In maths form, this is how we get the signal line:Signal = EMA [certain period] of MACDGenerally, a 12 day EMA is often userd as the EMA[shorter period]; 26 day EMA for the EMA[longer period]; and 9 day EMA of MACD is used as the signal line. These are the standard figures used by the creator of MACD, Gerald Appel, when the technical indicator first used in 1979. Another popular calculation periods in modern days is 7, 13, 5; where EMA[7] is used for the short period, EMA[13] is used for the long period, and 5 days for EMA of MACD (the signal line).Again, translating words to maths presentation, this is how a standard MACD calculations looks like:MACD = EMA [12] - EMA[26]Signal = EMA [9] of MACD

MACD Indications

ere's how traders take MACD as trading indicators. From the maths of MACD,MACD = EMA [12] - EMA[26]Signal = EMA [9] of MACDA bullish signal (buy in signal) is triggered wheneverA positive MACD (12-day EMA is trading above the 26-day EMA, EMA[12] > EMA[26])Moving average positive crossover (MACD is trading above the EMA[9] of MACD)Center line positive crossover (MACD=0 and MACD is trading above the EMA[9] of MACD)A bearish signal (sell off signal) is triggered wheneverA negative MACD (12-day EMA is trading below the 26-day EMA, EMA[12] < EMA[26])Moving average negative crossover (MACD is trading below the EMA[9] of MACD)Center line negative crossover (MACD=0 and MACD is trading below the EMA[9] of MACD)MACD is more than just about market momentum, it also gives the signal in the trend indication.If MACD is positive and rising, then the gap between the 12-day EMA and the 26-day EMA will be widening. This indicates that the rate-of-change of the faster moving average is higher than the rate-of-change for the slower moving average. Positive momentum is increasing and this would be considered bullish. If MACD is negative and declining further, then the negative gap between the faster moving average and the slower moving average will be expanding. Downward momentum is accelerating and this would be considered bearish.Often in reality, the Forex exchange price may drop to new selloff low but the MACD does not hit the new low, this maybe the sign of end of bearish. Or vise versa, the Forex exchange price may hit new high but the MACD might not be hitting on the new high point, this often indicates the change of trend from bullish to bearish

Usage of MACD divergence in Forex trading

The major usage (or benefit) of trading with MACD divergence is that the MACD chart has the ability to overshadow on trend change, which in turn trigger the sell off or buy in signal. Simply said, negative divergence indicates a change of bullish trend to bearish, while a positive divergence indicates a change of bearish trend to bullish. As MACD trading is taking a relative simple approach on the market, MACD is often used along with other technical analysis (stochastic oscillator for example).

Relative Strength Index (RSI) in Forex trading

The Relative Strength Index (RSI) is one of the popular Technical Indicators in oscillator charting methods. RSI is normally used to compare the currency strength and to predict currency price movements.Mathematics calculations behind RSI charting: RSI= 100 - 100/(1+RS) where RS = sum of positive closing prices divide by sum of negative closing prices. RSI helps traders to predict price movements and to identify market turning points. Rising in RSI will normally followed by a rise in currency price; vise versa, downtrend RSI indicates that the currency price is more likely dropping

How does a faulty Forex dealer cheat your money?

Forex market is a non-centralized market. There is no common market place for Forex traders and there is no so-call ‘standard’ in foreign currency exchange price. Different Forex dealers offer very different deals to their customers.As an individual FX trader, you depends solely on the dealer to make a transaction in your trades, thus picking up the right dealer is extremely crucial in your risk.You may wonder how does a faulty dealer can cheat on your money as all investment call have to go thru your decisions.Well, here's a typical example:Often a bad dealer is not totally scams.They are smart persons that trick money from traders that are not well-aware. These dealers, often known as retail market makers, will often encourage their clients to trade on margin and set stop loss orders, which allow the market makers to close out trades almost at will during busy markets at prices they have set. If the market maker does not offset the trader's position, the loss generated when a stop loss is triggered becomes the market maker's gain.Trade prices are easily skewed one way or the other depending on the retail trader's position, which is known by the market maker.Traders can be encouraged to take risky positions just before major economic announcements. If all else fails, the market maker can quote extreme prices (known as spiking) to trigger stop loss orders while the client is at work or asleep.The vast majority of retail FX traders are not profitable. For those losing retail speculators, much of the funds they had on deposit will be, in some form or another, transferred to the market maker

Parabolic SAR in Forex trading

Parabolic SAR is a technical analysis method to predict entry and exit points in Forex Market. It's widely used in Forex trading market because of its accuracy during trending period. Parabolic SAR is a time/price system. It was first introduced by J.Welles Wilder in his acclaimed book "New Concepts in Technical Trading Systems" (1978). SAR stands for 'stop and reverse' and the term 'parabolic' comes from the shape of the curve (resembling a parabola) created on the technical chart.

Creating Profitable Forex Trading Systems in Five Easy Steps

There is an old saying that is loosely translated to 'if I don’t help myself, who will?’ now while this isnt very elloquent, it does convey what i want to tell you.No entrepreneurship, no success, no money making scheme, is done if you don’t have a hand in it. So don’t rely on what other people can do for you, just get it done for yourself.Now while this rule applies to everything, it’s specifically useful regarding the forex market (foreign exchange). The forex is the biggest, most liquid market on the planet. Basically it trades currencies and is estimated that over 2 trillion dollars pass hands each day. Just to give you perspective, the new your stock exchange (also a huge endeavor), 'only' processes about 50 billion dollars a day. Get the picture?I bet I can guess your thoughts right about now. Well, maybe not the actual thought so much as the sentiment. You want some. 2 trillion is too much to be ignored and any person with a sturdy head on their shoulders would want a piece of the action. But in order to do that, you need to know at least the minimum for forex trading.We understand that you can’t know or operate everything; you will need porters, or advisers or just plain friends to call when you’re in a bind, but don’t you want to be the one to make the call about whets best for you? The only way you can do that is if you learn, so make sure you understand whets going on before you take even a step into the world of forex trading.

How do you start trading Forex?

Now you need to find a forex system that will help you along with your trading. You need to find the right system for you, so don’t ever tire of looking. You can find trading systems all over the market (the internet really) and they could and will help you make hundreds, if not thousands of times over any dime you pay up front.You might think it’s difficult to get your trading system personalized or up and running in general, even if it’s standard. You might even find it hard to make a choice, but all it ever comes down to is knowledge, and that is what we are here for.You can find the trading system for you if you just take into account 5 different pointers (that’s it, five!!) but before we get there, there are three things you have to know. So lets start there, and then we can move on to the pointers.The first things you have to know is don’t fall into the gadget trap.Just because it’s shiny doesn’t mean you need it. It’s actually, almost on the contrary. The simpler the system the better it will probably be for your forex needs, so stay away from the forex trading/cappuccino making/ironing/phone/camera combo. Stick to the basics and you will be fine. Another thing that should be obvious to you is that you, as your trading system, should be in the business of cutting losses and running with any profit possible.You need a system that can identify possible profits and (ideally) instantly cut losses. This could save you a great deal of money, so don’t turn on your computer before you’re convinced that this is what your system does. The last of the three things you should know is that you need a system that can recognize long term trends. if your computer is only analyzing days when deciding to sell or buy, then you will never get more then pennies to your dollar, and that just isn’t enough when there are two trillion to be had.

Getting started in FOREX trading

Getting started in FOREX trading

You don’t need much to get started with FOREX trading. A computer with Internet access, a funded FOREX account with foreign currency exchange broker, and a trading system should be sufficient to get things started.To reduce the risks of losing money, some basic charting knowledge is as well recommended before you start trading FOREX. FOREX charts assist the investor by providing a visual representation of exchange rate fluctuations. Many variables affect currency exchange rates, such as interest rates, bank policies, geopolitics, and even the time of day may affect exchange rates. As stated by expert FOREX trader Peter Bain, charting is an essential tool in FOREX trading.In his newsletter, he reveals that daily charts, hourly charts, and 15-minute charts are used while trading in FOREX. As quoted from his informative newsletter -- “Daily chart will help you define the overall trend from a position trading point-of-view, and the hourly (one hour) chart will give you a feel for the intraday trend. The 15-minute chart is used for entry and exit – with assistance from the five-minute chart, where price is moving quickly, and you need to be closer to the action.”Being one of the technical method, FOREX charting is based on the principal ‘history repeats itself’. FOREX traders who study charts predict the market future by evaluating past market performance. The time frame used for charting might differs for different traders, some analyze the past one week, some prefer six months analysis, and there are also traders who analyze the market for the past five to ten years before getting involved in a FOREX trade. A huge variety of FOREX charts are available in the market. Some charting methods are very simple, using a few FOREX indicators to show trading direction; other charts may include up to forty indicators and those are mainly for advance traders that are more skillful. MACD Divergence, RSI, RSI range, and price are some of the well known indicators in charting.

Facts about foreign currency exchange market

FOREX market is the largest trading market in the world. It yields an average turnover of $1.9 trillion daily and the figure is nearly 30 times larger than the total volume of equity trades in United States.FOREX trading is very unique as the trades are done between two counterparts via electronic network or telephone connections. There is no centralized location as stocks or futures markets and trades are done around the clock. Everyday FOREX trade begins when the financial centers in Sydney start their day, and moves around the globe to Tokyo, London, and then New York. Traders can always response to the market regardless of the local time.Although FOREX trading involves such a big volume of trades nowadays, it is not made available for the publics until year 1998. In the past, the FOREX market was not offered to small speculators or individual traders due to the large minimum business sizes and extremely strict financial requirements. At that time, only banks, big multi-national cooperation and major currency dealers were able to take advantage of the currency exchange market's extraordinary liquidity and strong trending nature of world's main currency exchange rates. Only until the late 90s (year 1998), FOREX brokers are allowed to break huge sized inter-bank units into smaller units and offer these units to individual traders like you and me.Nowadays with the rapid growth of Internet and communications technology, FOREX trading has become one of the hottest make-money-at-home-businesses for those who wish to avoid conventional 9-5 day job. As a fact in FOREX trading, FOREX is mainly traded in large international bank. According to Wall Street Journal Europe, 73% of the trade volume is covered by the major ten. Deutsche Bank, topping the table, had covered 17% of the total currency trades; followed by UBS in the second and Citi Group in third; taking 12.5% and 7.5% of the market.

What exactly is the Employment Situation Report?

The Employment Situation Report, also commonly called the Labor Report, is an economic indicator that basically reports on the number of people out of work in the country, as well as on general wage rates, etc. The first part of the Employment Situation Report is called the household survey, which surveys approximately 60,000 households throughout the country about those out of work. From that number, the general unemployment rate is calculated. In other words, the household survey is a very powerful survey that helps determine the country’s overall unemployment rate. The household survey is basically a lagging indicator, which means that any changes that occur in the number of people out of work usually happen after changes in an economy. If the economy is strong, the number of people out of work will generally soon decrease (positive effect on the currency rate), while if the economy slows down, the effect on the number of unemployed people might not be felt until a few months later (negative effect on currency rate).

The Economic Situation Report and the Forex Market

The Forex market, like most investment markets, is often glued to economic reports that are published on a monthly or even quarterly basis. Some of the more common economic reports or indicators that can influence and shape trade decisions in an investment market are the Consumer Price Index (CPI), the Gross Domestic Product (GDP), the Housing Price Index (HPI), and the Employment Situation Report. The Employment Situation Report is one of the most popular indicators around, where changes in the employment rate and hourly wage rates can influence overall currency rates

FOREX - Where Fortunes Are Made Everyday

The Foreign Exchange Market – better known as FOREX - is a world wide market for buying and selling currencies. It handles a huge volume of transactions 24 hours a day, 5 days a week. Daily exchanges are worth approximately $1.5 trillion (US dollars). In comparison, the United States Treasury Bond market averages $300 billion a day and American stock markets exchange about $100 billion a day.

Market size and liquidity

As such, it has been referred to as the market closest to the ideal perfect competition, notwithstanding market manipulation by central banks. According to the Bank for International Settlements, average daily turnover in global foreign exchange markets is estimated at $3.98 trillion. Trading in the world's main financial markets accounted for $3.21 trillion of this. This approximately $3.21 trillion in main foreign exchange market turnover was broken down as follows:

Of the $3.98 trillion daily global turnover, trading in London accounted for around $1.36 trillion, or 34.1% of the total, making London by far the global center for foreign exchange. In second and third places respectively, trading in New York accounted for 16.6%, and Tokyo accounted for 6.0%. In addition to "traditional" turnover, $2.1 trillion was traded in derivatives. Exchange-traded forex futures contracts were introduced in 1972 at the Chicago Mercantile Exchange and are actively traded relative to most other futures contracts. Forex futures volume has grown rapidly in recent years, and accounts for about 7% of the total foreign exchange market volume, according to The Wall Street Journal Europe (5/5/06, p. 20).

Foreign exchange trading increased by 38% between April 2005 and April 2006 and has more than doubled since 2001. This is largely due to the growing importance of foreign exchange as an asset class and an increase in fund management assets, particularly of hedge funds and pension funds. The diverse selection of execution venues such as internet trading platforms offered by companies such as First Prudential Markets and Saxo Bank have made it easier for retail traders to trade in the foreign exchange market. Because foreign exchange is an OTC market where brokers/dealers negotiate directly with one another, there is no central exchange or clearing house. The biggest geographic trading centre is the UK, primarily London, which according to IFSL estimates has increased its share of global turnover in traditional transactions from 31.3% in April 2004 to 34.1% in April 2007. RPP The ten most active traders account for almost 73% of trading volume, according to The Wall Street Journal Europe, (2/9/06 p. 20). These large international banks continually provide the market with both bid (buy) and ask (sell) prices. The bid/ask spread is the difference between the price at which a bank or market maker will sell ("ask", or "offer") and the price at which a market-maker will buy ("bid") from a wholesale customer. This spread is minimal for actively traded pairs of currencies, usually 0–3 pips. For example, the bid/ask quote of EUR/USD might be 1.2200/1.2203 on a retail broker. Minimum trading size for most deals is usually 100,000 units of currency, which is a standard "lot". These spreads might not apply to retail customers at banks, which will routinely mark up the difference to say 1.2100 / 1.2300 for transfers, or say 1.2000 / 1.2400 for banknotes or travelers' checks. Spot prices at market makers vary, but on EUR/USD are usually no more than 3 pips wide (i.e. 0.0003). Competition is greatly increased with larger transactions, and pip spreads shrink on the major pairs to as little as 1 to 2 pips.

Market participants

Unlike a stock market, where all participants have access to the same prices, the forex market is divided into levels of access. At the top is the inter-bank market, which is made up of the largest investment banking firms. Within the inter-bank market, spreads, which are the difference between the bid and ask prices, are razor sharp and usually unavailable, and not known to players outside the inner circle. The difference between the bid and ask prices widens (from 0-1 pip to 1-2 pips for some currencies such as the EUR). This is due to volume. If a trader can guarantee large numbers of transactions for large amounts, they can demand a smaller difference between the bid and ask price, which is referred to as a better spread. The levels of access that make up the forex market are determined by the size of the “line” (the amount of money with which they are trading). The top-tier inter-bank market accounts for 53% of all transactions. After that there are usually smaller investment banks, followed by large multi-national corporations (which need to hedge risk and pay employees in different countries), large hedge funds, and even some of the retail forex-metal market makers. According to Galati and Melvin, “Pension funds, insurance companies, mutual funds, and other institutional investors have played an increasingly important role in financial markets in general, and in FX markets in particular, since the early 2000s.” (2004) In addition, he notes, “Hedge funds have grown markedly over the 2001–2004 period in terms of both number and overall size” Central banks also participate in the forex market to align currencies to their economic needs.

Banks

The interbank market caters for both the majority of commercial turnover and large amounts of speculative trading every day. A large bank may trade billions of dollars daily. Some of this trading is undertaken on behalf of customers, but much is conducted by proprietary desks, trading for the bank's own account.

Until recently, foreign exchange brokers did large amounts of business, facilitating interbank trading and matching anonymous counterparts for small fees. Today, however, much of this business has moved on to more efficient electronic systems. The broker squawk box lets traders listen in on ongoing interbank trading and is heard in most trading rooms, but turnover is noticeably smaller than just a few years ago.

Commercial companies

An important part of this market comes from the financial activities of companies seeking foreign exchange to pay for goods or services. Commercial companies often trade fairly small amounts compared to those of banks or speculators, and their trades often have little short term impact on market rates. Nevertheless, trade flows are an important factor in the long-term direction of a currency's exchange rate. Some multinational companies can have an unpredictable impact when very large positions are covered due to exposures that are not widely known by other market participants.

Hedge fund & Investment management firms

Hedge funds have gained a reputation for aggressive currency speculation since 1996. They control billions of dollars of equity and may borrow billions more, and thus may overwhelm intervention by central banks to support almost any currency, if the economic fundamentals are in the hedge funds' favor.

Investment management firms (who typically manage large accounts on behalf of customers such as pension funds and endowments) use the foreign exchange market to facilitate transactions in foreign securities. For example, an investment manager bearing an international equity portfolio needs to purchase and sell several pairs of foreign currencies to pay for foreign securities purchases.

Some investment management firms also have more speculative specialist currency overlay operations, which manage clients' currency exposures with the aim of generati

Technical indicators Tutorial

Price is the primary tool of technical analysis because it reflects every factor affecting the value of a market. However, price doesn’t produce just trend lines and basic chart patterns. Analysts have expanded their research far beyond those basic elements to develop a number of technical indicators that provide more insight into price action than what you see on the surface. You may be able to see that a market is “extended” (overbought or oversold) just by looking at a bar chart, but an indicator can put a number to it and confirm your thinking.

A Foreign Exchange (FOREX) Trading Primer

The largest traded “market” in the world is not the U.S., Japanese or European stock markets. It’s the foreign exchange market. It’s called Forex for short, or also called the cash currency market. Speculators can and do trade this huge market, in which nearly 2 trillion dollars (and other currencies) can change hands every day.

5 Important Strategies in Forex Trading

When trading in Forex market, it is important to work out winning strategies beforehand if at all possible. Making decisions regarding your forex trading and developing a strategy can be seen as your foundation. With your strategy you will optimize your risk with respect to the expected reward, or put the odds in your favor. Trading strategies should be disciplined and limit risk, while placing you at the most favorable advantage in the market. One strategy is the simple moving away average, which is based on a technical study over twelve periods, with each period fifteen minutes in length. This is a good example of a trading decision that is arrived at through strategy.

Fundamentals of Short-Term Trading

In this article, I will describe patterns of price behavior on an intraday basis and their implications for trading. I believe that an adequate consideration of how price changes actually occur during the day will challenge traditional methods of trading and open the door to new ways of viewing and analyzing the markets.

The Challenge of Stationarity

I’d like to begin this article with a set of descriptive data on the ES market, the main market that I trade. For purposes of convenience, I looked at the market between October 9th, 2003 and January 16th, 2004, which gave me 68 full days of data. I broke down each trading morning (9:30 ET - 12:00 ET) into half-hour segments to see how each segment compares to the ones around it. Below is a table of the average range and standard deviation (in ES points) for each 30 minute period in the morning

Get A Basic Forex Education Before You Start Trading

Forex can be very intriquing. To the uninitiated, it can be very complicating. Foreign exchange (currency or forex or FX), is all about money. Money from all over the world is bought, sold and traded. On the Forex market, anyone can buy and sell currency and with possibly come out ahead in the end. When dealing with the foreign currency exchange, it is possible to buy the currency of one country, sell it and make a profit. For example, a trader might buy a Japanese yen when the yen to dollar ratio increases, then sell the yens and buy back American dollars for a profit.

Mechanics of Trading Through Brokers:Voice Brokers and Electronic Brokering Systems

The traditional role of a broker is to act as a gobetween in foreign exchange deals, both within countries and across borders.Until the 1990s, all brokering in the OTC foreign exchange market was handled by what are now called live or voice brokers. Communications with voice brokers are almost entirely via dedicated telephone lines between brokers and client banks. The broker’s activity in a particular currency is usually broadcast over open speakers in the client banks, so that everyone can hear the rates being quoted and the prices being agreed to, although not specific amounts or the names of the parties involved. A live broker will maintain close contact with many banks, and keep well informed about the prices individual institutions will quote, as well asthe depth of the market, the latest rates where business was done, and other matters. When a customer calls, the broker will give the best price available (highest bid if the customer wants to sell and lowest offer if he wants to buy) among the quotes on both sides that he or she has been given by a broad selection of other client banks. In direct dealing, when a trader calls a market maker, the market maker quotes a twoway price and the trader accepts the bid or accepts the offer or passes. In the voice brokers market, the dealers have additional alternatives.Thus,with a broker, a market maker can make a quote for only one side of the market rather than for both sides.Also, a trader who is asking to see a quote may have the choice, not only to hit the bid or to take (or lift) the offer, but also to join either the bid or the offer in the brokers market, or to improve either the bid or the offer then being quoted in the brokers market. At the time a trade is made through a broker, the trader does not know the name of the counterparty. Subsequently, credit limits are checked, and it may turn out that one dealer bankmust refuse a counterparty name because of credit limitations. In that event, the broker will seek to arrange a name-switch—i.e., look for a mutually acceptable bank to act as intermediary between the two original counterparties. The broker should not act as principal.Beginning in 1992, electronic brokerage systems (or automated order-matching systems) have been introduced into the OTC spot market and have gained a large share of some parts of that market.In these systems, trading is carried out through a network of linked computer terminals among the participating users.To use the system,a trader will key an order into his terminal, indicating the amount of a currency,the price,and an instruction to buy or sell. If the order can be filled from other orders outstanding, and it is the best price available in the system from counterparties acceptable to that trader’s institution, the deal will be made. A large order may be matched with several small orders.If a new order cannot be matched with outstanding orders, the new order will be entered into the system, and participants in the system from other banks will have access to it. Another player may accept the order by pressing a “buy”or “sell” button and a transmit button. There areother buttons to press for withdrawing orders and other actions.Electronic brokering systems now handle a substantial share of trading activity. These systems are especially widely used for small transactions (less than $10 million) in the spot market for the most widely traded currency pairs—but they are used increasingly forlarger transactions and in markets other than spot. The introduction of these systems has resulted in greater price transparency and increased efficiency for an important segment of the market. Quotes on these smaller transactions are fed continuously through theelectronic brokering systems and are available to all participating institutions, large and small, which tends to keep broadcast spreads of major market makers very tight. At the same time electronic brokering can reduce incentives for dealers to provide two-way liquidity for other market participants. With traders using quotes from electronic brokers as the basis for prices to customers and other dealers, there may be less propensity to act as market maker. Large market makers report that they have reduced levels of first-line liquidity. If they need to execute a trade in a single sizeable amount, there may be fewer reciprocal counterparties to call on. Thus, market liquidity may be affected in various ways by electronic broking. Proponents of electronic broking also claim there are benefits from the certainty and clarity of trade execution.For one thing there are clear audit trails, providing back offices with information enabling them to act quickly to reconcile trades or settle differences. Secondly, the electronic systems will match orders only between counterparties that have available credit lines with each other.This avoids the problem sometimes faced by voice brokers when a dealer cannot accept a counterparty he has been matched with, in which case the voice broker will need to arrange a “credit switch,” and wash the credit risk by finding an acceptable institution to act as intermediary. Further, there is greater certainty about the posted price and greater certainty that it can be traded on. Disputes can arise between voice brokers and traders when, for example, several dealers call in simultaneously to hit a given quote. These uncertainties are removed in an electronic process. But electronic broking does not eliminate all conflicts between banks. For example, since dealers typically type into the machine the last two decimal points (pips) of a currency quote, unless they pay close attention to the full display of the quote, they may be caught unaware when the “big figure”of a currency price has changed. With the growth of electronic broking, voice brokers and other intermediaries have responded to the competitive pressures.Voice brokers have emphasized newer products and improved technology. London brokers have introduced a new automated confirmation system, designed to bring quick confirmations and sound audit trails. Others have emphasized newer products and improved technology.Therehave also been moves to focus on newer markets and market segments. The two basic channels, direct dealing and brokers—either voice brokers or electronic broking systems—are complementary techniques, and dealers use them in tandem. A trader will use the method that seems better in the circumstances, and will take advantage of any opportunities that an approach may present at any particular time. The decision on whether to pay a fee and engage a broker will depend on a variety of factors related to the size of the order, the currency being traded, the condition of the market, the time available for the trade, whether the trader wishes to be seen in the market (through direct dealing) or wants to operate more discreetly (through brokers), and other considerations.The 1998 Federal Reserve turnover survey indicated that brokers handled 41 percent of spot transactions, and a substantially smaller percentage of outright forwards and FX swaps. Altogether, 24 percent of total U.S. foreign exchange activity in the three traditional marketswas handled by brokers. In the brokers market, 57 percent of turnover is now conducted through automated order-matching systems, or electronic brokering, compared with 18 percent in 1995.

Forex Profit System Foundations

Before we begin looking at the specifics of the FPS and how it works, let’s look at 4 building blocks that I believe to be foundations to the Forex Profit System.Foundation #1: I highly recommend that you follow 1 or maybe 2 major currency pairs. It gets far too complicated to keep tabs on all four. I also recommend that traders choose one of the majors because the spread is the best and they are the most liquid. I personally follow only USD/CHF because it moves the most every day.Foundation #2: Follow and understand the daily Forex News and Analysis of the professional currency analysts. Even though this system is based solely on technical analysis of charts, it is important to get a birds-eye view of the currency markets and the news that affects the prices. It is also important that you know and understand what the key technical ‘support’ and ‘resistance’ levels are in the currency pair that you want to trade. Support is a predicted level to buy (where currency pair should move up on the charts), resistance is a predicted level to sell (where the currency pair should move down on the charts). 3 Fortunately, all the best Forex news and analysis is offered free on the Internet. Here is what you should do first:*While you are reading the daily news and technical analysis, write down on a piece of paper what direction the analysts are saying about the major currency pair you are following and the key support and resistance levels for the day.A. Go to www.forexnews.com and you will find 24hr news and analysis on the spot FX markets. The site will give you the big picture of how the economic calendar and central banks affect the currency markets. A great resource.B. Next visit Commerzbank’s Daily Market Technicals here: http://wwidetrader.blogspot.com/www.commerzbank.com/upload/dailye.pdf This daily commentary gives you supports and resistances and predicted direction of the major currency pairs and crosses. One of the best.C. Then go to www.fxstreet.com and click on the ‘Top Forex Reports’. Here there is a wonderful listing of all the major daily currency analysis and forecasts with support and resistance and direction forecasts.D. Click on www.currencypro.com and go to ‘Today’s Market Research’ and there you will find more excellent analysis on the Major Currency pairs. Another great Forex Portal.Foundation #3: Only get into a trade when the FPS technical indicators say when. Always trade with stop losses! It is important when you are trading Forex, to be disciplined and to stick to a plan. Don’t just trade your ‘gut’ feeling. Use the technical indicators outlined and always enter in stop losses on every trade.Foundation #4: Practice makes perfect. As they say, there is no substitute for hard work and diligence. Practice this system on a demo account and pretend the virtual money is your own real money. Do not open a live trading account until you are profitable trading on a demo account. Stick to the plan and you can be successful.

Demo Account Setup

The 5th lesson is finally here! I will show you how to get started trading the Forex100% risk free. After this lesson you will start to experiment with Forex trading.You will not be a master trader the first day. It is important that you persist in yourefforts. You have to keep trying until you succeed. There are a few things that Iwant to explain that you should know before attempting to set up your demoaccount.I want to explain a little more about the currency pairs. Currencies are alwaystraded in pairs in the Forex. The pairs have a unique notation that expresses whatcurrencies are being traded. The symbol for a currency pair will always be in theform ABC/DEF. ABC/DEF is not a real currency pair, it is an example of a symbolfor currency pairs. In this example ABC is the symbol for one countries currencyand DEF is the symbol for another countries currency.Here are some of the common symbols used in the Forex:USD - The US DollarEUR - The currency of the European Union "EURO"GBP - The British PoundJPN – The Japanese YenCHF - The Swiss FrancAUD – The Australian DollarCAD - The Canadian DollarThere are symbols for other currencies as well, but these are the most commonlytraded ones. A currency can never be traded by itself. So you can not ever trade aEUR by itself. You always need to compare one currency with another currency tomake a trade possible. Some of the common pairs are the EUR/USD, GBP/USD,EUR/AUD, USD/CAD, etc...The currency pair looks like a fraction. The numerator (top of the fraction) is calledthe base currency. The denominator (bottom of the fraction) is called the countercurrency. When you place an order to buy the EUR/USD, you are actually buyingthe EUR and selling the USD. If you were to sell the pair, you would be selling theEUR and buying the USD. So if you buy or sell a currency PAIR, you arebuying/selling the base currency. You are always doing the opposite of what youdid with to base currency with the counter currency.If this seems confusing then you're in luck. You can always get by with justthinking of the entire pair as one item. Then you are just buying or selling that oneitem. Thinking like this will still enable you to place trades. You only need to beaware of the base/counter concept for fundamental analysis issues. S o why is it important to know about the base/counter currency now?The base/counter currency concept illustrates what is actually taking place in a Forextransaction. I mentioned before that short-selling was restricted in the stockmarket. Short-selling is where you sell a stock/currency/option/commodity firstand then try to buy it back at a lower price later. But in the Forex, you are alwaysbuying one currency (base) and selling another (counter). If you sell the pair youare simply flipping which one you buy and which one you sell. The transaction isessentially the same.This allows you to short-sell with no restrictions!You want to be able to short-sell with no restrictions so you can make moneywhen the market drops as well as when it rises. The problem with traditional stockmarket trading is that the market has to go up for you to make money. With Forextrading you can make money in all directions.Another important concept for Forex trading is the leverage. Leverage is whenyou can use a little money to control a lot of money. The Forex market is probablythe highest leverage market in the world. There are different types of leverageavailable in Forex trading. The highest leverage possible is 200:1. This meansthat if you put up $1 margin, the trading provider will allow you to trade with $200.So if the price of the currency pair goes up 1%, you make 200*1%=200%!The margin for Forex trading is a good faith promise to the trading provider. Othermoney in your trading account also insures your transaction. You only need toknow that the margin is the amount of money you need to place a trade.Another important piece of lingo is the term "pips". Since we have the EUR/USD,EUR/AUD, etc..., we need a way to talk about the number or price. When you seea Forex currency pair price quote, the last digit of the price is commonly referredto as a pip. So if you see a price quote of 1.6118 and then a price quote oneminute later of 1.6119, the price rose 1 pip. Similarly, if we see a price quote of187.50 and then another one 5 minutes later of 187.58, the price rose 8 pips. Thepip is always the last decimal place of the currency price quote.These lessons literally could go on for several years and you still would not knoweverything. At this point, you are ready to start demo trading. Once you begin toplace demo trades, you will learn a lot about how Forex transactions are placed.This is an important step for you to be able to learn how to become a trader.Important Note: Just fooling around in a demo account can be a great learningexperience. You will not learn how to become a trader this way. You need to havea trading strategy, like the ones at trend strategy store.Here's how to get started with your own demo account.Go to http://fxcm.com/mini-demo-registration.htmlThere you can sign up for a free mini-demo account. A mini account is just like areal demo account, except the trade sizes are smaller. In a real account the smallest trade size is $100,000; in a mini account the smallest trade size is$10,000 (this can be done with a $50 margin, the power of leverage!).There are several other places online to sign up for a free demo account. I usefxcm, because they have the best overall reputation online. Fxcm has built itself tothe premier Forex trading platform. I don't get paid anything to endorse them, butthey are currently the best.Once you sign up for your mini-demo account, you will need to try out one of thetrial charting packages. Any of these will do because they all have the SMA. Youcan then set up your demo account and use the SMA crossover method fromlesson #3. This is a good way to get used to how orders are placed. Once youhave a real trading system, you will already know how to place orders properly.Everyone makes mistakes placing orders. You need to experiment in a demoaccount to make your mistakes without losing money.At this point you have to make a decision about how fast you would like to learnhow to become a trader. The truth is that the longer you wait to get in on thismarket, the more potential money you are missing out on. You need to decidewhat time frame is right for you to begin trading.You need to decide if:1. You want to place real trades within the next 3 months (or sooner, dependingon your desire)2. You want to build your knowledge for several months before placing realtrades.The choice is entirely yours. No-one else can make that decision for you. Youneed to make a plan and stick to it. It is important not to put off your success.Success requires action.If you want to place real trades within the next 3 months, you should check out4xtrend. There are some great resources at extremely affordable prices that canget you trading in a very short amount of time.At this point, I would like to congratulate you on completing the Insider Secrets ofOnline Currency Trading course! You have already showed a level ofperseverance that most people lack.I would also like your input on any aspect of Insider Secrets of Online CurrencyTrading. I am interested in any parts you found helpful, insightful, confusing,etc... Any feedback about this course would be extremely helpful for all of thereaders. This is largely a collective effort; by contributing you benefit yourself andothers. Simply post your questions to commentsHere is a recap of what you should be doing right now to pursue your Forex trading goals:1. Setup a free demo account by going to:http://fxcm.com/mini-demo-registration.html2. Decide your time frame on when you want to enter the market. If you want toget there as quick as your heart's desire, go to www.4xtrend.com. If you want totake your time, sign up for the Forex system course.3. Be persistent and never give up!

WHAT ARE THE RISKS OF INVESTING IN STOCKS

While it is true, that stock investment is the most volatile of all securities, investors might well recall the fact that uncertainty, is a permanent feature of any investing perspective. This means that risk is always a part of any investment. A better attitude would be to limit and manage your risk. A maximum level of gain or loss should be set, and calculated decisions should be made when this level is reached.

WHAT IS THE MINIMUM AMOUNT OF INITIAL INVESTMENT

Some brokers may require a minimum initial investment to open an account depending on their requirement or may charge or waive other fees depending on the amount you initially invest.If you are just getting started with a small investment, look for an investment firm that would not penalize you based on the size of your investment.The minimum amount of money needed to invest in the stock market depends on the minimum number of shares to be traded for the stock. The minimum shares will be determined by the prevailing market price of a particular stock, as each stock, the minimum number of shares to be traded is fixed, called the market-lot, which depends on the price range of the stock.The market lot is calculated biannually by NCCPL, keeping the lot size to 500-shares for scrip which are priced less than Rs. 50 and lot size of 100-shares for scrip priced above Rs. 50

WHAT IS THE CENTRAL DEPOSITORY COMPANY (CDC)/CENTRAL DEPOSITORY SYSTEM (CDS)

The CDC is a company that operates an electronic share register called the Central Depositary System (CDS). The CDS eliminates the need for physical movement of share certificates. CDC electronically manages book entry system for custody and transfer of securities. CDS was introduced to replace the manual system of physical handling and settlement of shares at the stock exchange and is managed by the Central Depository Company (CDC), which is incorporated under the Central Depositories Act 1997. Investors can open their accounts directly with CDC called Investor Accounts or open sub accounts with a brokerage firm. It has also solved investor problems related to stock handling on the settlement date, registration of shares, and exercise of corporate action benefits. Visit CDC website for further details regarding shares safe keeping.

WHAT IS STOCK EXCHANGE

A stock exchange, share market or bourse is an organization which provides "trading" facilities for stock brokers and traders, to trade shares of the listed companies and other financial instruments such as Term Finance Certificates and Derivatives. Stock exchanges also provide facilities for the issue (listing), redemption (delisting) of securities and other capital events including the payment of income and dividends. Karachi Stock Exchange (KSE) is a modern market where trading takes place with electronic trading system called Karachi Automated Trading System (KATS), which gives the Exchange advantages of speed and minimum cost of transactions. Trades on an exchange are by members only

THE INITIAL OFFERING OF STOCKS (IPO):

The initial offering of stocks and bonds to investors is by definition done in the primary market (IPO) and subsequent trading is done in the secondary market. Initial Public Offering (IPO) is the initial sale by a company of shares of its stock to the public in the financial market

WHAT ARE SHARES

Shares, as the name says, are shares in a limited company. Each shareholder is a partial-owner of the company in which they have bought shares and investors can buy and sell their shares on the stock exchanges. Companies on incorporation issue shares, (also called equities) and later perhaps when they are building up a business. The original shareholders might still own them, or they may have sold them to someone else through the stock market. If the company makes a profit, the shareholders normally have some of it passed to them in the form of dividends. The amount paid in dividends varies year by year, depending on how profitable the company has been and how much money the directors and the company management want to keep in reserve for future expansion.There are different ways in which you can participate in the stock market:1. Directly: by buying and selling shares;2. Indirectly: through a collective vehicle, in which shares are grouped together, such as a mutual fund or Exchange Traded Funds (ETFs).

BOOK BULIDING PROCESS FOR NEW COMPANIES

Book Building is the process of price discovery and pricing a new share issue. The process by which an underwriter attempts to determine, at what price to offer an IPO based on demand from institutional investors for its efficient price discovery based on actual supply and demand by informed investors

Commodity Dollars Creeping Higher

A largely unexpected cut leaving Canada’s benchmark rate on a par with the top of the range of the fed funds rate and growing fears over the possibility of backdoor nationalization of some U.S. banks hurt risk appetite earlier today. The dollar in early morning trade has taken a breather…

Pound and Euro Are Fighting Back?

After the Asian session finished down more than 200 points, stocks have traded negatively, as has Europe amid poor bank earnings results, giving investors more reasons to worry about the economic future. All of this is despite the confidence we witnessed during recent days, mainly because traders know the worst…

Bank of Canada Cuts Target Rate by 25 Basis Points

The Bank of Canada cut the target for the overnight rate by 25 basis points to 0.25%, citing a deeper-than-expected recession in Canada and the fact that “measures to stabilize the global financial system have taken longer than expected to enact”. Markets were evenly split on whether the Bank would…

Canada Goes Japanese

Canada’s decision to target monetary reserves of C$ billion is textbook “quantitative easing” (not only credit easing), which is the way the Bank of Japan announced policy easing in 2002-04. Canadian dollar damaged across the board as the Bank of Canada is the latest central bank to dive into quantitative…

BOC Undermines Canadian Dollar

The Bank of Canada interest rate decision is clearly a short-term negative factor for the Canadian currency. The downbeat economic assessment also shows that there is a lack of confidence in US and global growth prospects given the Canadian dependence on trade. The Canadian outlook, therefore, is also likely to…

Euro/US Dollar and the US S&P 500

Euro/US Dollar Loses Correlation to S&P 500 - Time for Turn Lower

he Euro/US Dollar recently lost its correlation to the S&P 500, but an early-week decline in both the currency pair and equity index suggests that we are at a turning point for risk sentiment.

In our most recent US Dollar Weekly Forecast, we discuss reasons why the breakdown in the S&P/EURUSD correlation may herald a shift in the tide. Indeed, it seems as though financial markets reached an unsustainable ‘winning streak’ on the S&P’s sixth-consecutive weekly advance.

Euro/US Dollar and the US S&P 500 Index

The Euro/US Dollar temporarily lost its correlation to the S&P 500—leading many market analysts to claim that forex market dynamics had shifted. The US Dollar had previously moved almost tick-for-tick with the S&P and other key risk barometers, serving its traditional role as a safe-haven currency. The more recent disconnect suggested that it may have lost its allure as a store of value, but we would argue that paradigms are unlikely to shift so quickly. Instead, we view the breakdown in correlation as a contrarian sign of a market top.

As the S&P 500 hit impressive multi-month highs, the US Dollar and Japanese Yen generally drifted lower. Given broader currency and financial market trends, however, we believe it is only a matter of time before we see a breakdown in risk and sharp rallies in the USD and JPY. Indeed, early-week trade has already seen the EUR/USD break significant lows, and our fundamental and technical forecasts remain bearish.

Forex Correlations Summary

Forex correlations against Oil, Gold, and the Dow Jones Industrials Average for the past 30 calendar days:

Trend Channel and Fundamentals May Help Along a USDCHF Range

Over the past 24 hours we have seen a massive shift in risk sentiment and the result for the broader currency market was volatility. Does this move stand as a temporary reversal or a reestablished trend? Regardless of which category you fall into, it is a speculative bet that poses an ongoing threat to potential range setups. The fundamental and technical buffers for USDCHF are about as good as they come.

Currencies Confined to Inside Day Price Action Despite USD Offers (Daily Classical)

New Zealand Dollar Threatened By Declining Domestic Picture

Oil trades near $49 as stockpiles gain on economic slowdown

Oil was little changed near $49 a barrel, after falling the past two days, as U.S. crude stockpiles climbed amid signs of further economic weakness in the world’s biggest energy consumer.

U.S. retail sales unexpectedly fell 1.1 percent in March, the Commerce Department said yesterday. The industry-funded American Petroleum Institute said that oil inventories rose last week to their highest since 1990. The weekly Department of Energy report today will probably show that stockpiles increased to the highest since 1993.

“The fundamentals still don’t suggest any strength,” said Mark Pervan, a senior commodity strategist at Australia and New Zealand Banking Group Ltd. in Melbourne. “The supply levels are still at really high numbers for crude and that’s unlikely to change with the refinery capacity rates still very low.”

Crude oil for May delivery was at $49.48 a barrel, up 7 cents, in electronic trading on the New York Mercantile Exchange at 11:34 a.m. Singapore time. It earlier fell as much as 49 cents, or 1 percent, to $48.92 a barrel.

Oil is up 11 percent this year after tumbling 54 percent in 2008. Yesterday, crude dropped 64 cents, or 1.3 percent, to settle at $49.41 a barrel.

The U.S. used an average of 18.9 million barrels a day in the four weeks ended April 3, down 4.4 percent from a year earlier, the Energy Department said April 8, the lowest level since October.

Gross domestic product will contract by 3.8 percent in North America in 2009, the International Energy Agency said in a report April 10, dropping an earlier forecast for a recovery in the economy and oil demand in the second half of the year.

Increased Output As OPEC nations make their biggest oil production cuts on record, Brazil, Russia and the U.S. are pumping more, which may push crude further below $50 a barrel as demand slows.

U.S. imports fell by 148,000 barrels a day in January just as America’s production increased by 153,000, according to data compiled by the Energy Department in Washington. More oil is flowing just as the slowing economy causes consumption to contract for the second consecutive year.

Crude’s highest closing price this year was at $54.34 a barrel on March 26, up from a low of $33.98 a barrel on Feb. 12.

“Some of that optimism that we’re turning a corner economically has run its course,” said Toby Hassall, an analyst at Commodity Warrants Australia Ltd. in Sydney. “We’re not seeing enough good news flowing to extend the rally in oil prices.”

Equities Market An Australian leading economic index fell in February to contract at the fastest annual pace since 1982.

The index, a gauge of future economic growth, dropped 0.3 percent to 248.6 points from 249.4 in January, Westpac Banking Corp. and the Melbourne Institute said in Sydney today. The index shrank at an annualized rate of 5.1 percent.

U.S. equities dropped for the first time in four days yesterday as declines in retail sales offset optimism from Federal Reserve Chairman Ben S. Bernanke that the pace of the economy’s slump may be slowing.

The Standard & Poor’s 500 Index slipped 1.3 percent to 847.16. The Dow Jones Industrial Average dropped 94.7 points, or 1.2 percent, to 7,963.11.

Asian stocks dropped for the first time in five days as the outlook dimmed for earnings for companies in Japan, the world’s third-largest oil user.

“There are concerns that the equity market gains can’t be sustained now that we’re near 8,000 in the Dow,” said Commodity Warrant’s Hassall. “If we see equities come off after this recent rally it will be difficult for crude oil to stay at this level.”

Inventories Gain The API reported yesterday that oil supplies increased 6.51 million barrels to 371.2 million last week.

Oil-supply totals from the API and DOE moved in the same direction 76 percent of the time over the past four years, according to data compiled by Bloomberg.

An Energy Department report today may show supplies rose 1.75 million barrels last week, according to the median of 14 responses in a Bloomberg News survey. Stockpiles in the week ended April 3 were the highest since July 1993 as refiners shut units for maintenance and producers outside the OPEC countries increased shipments.

“Obviously we’ve got a big overhang in inventories,” said Commodity Warrants’ Hassall. “Demand still remains very weak.”

Brent crude oil for May settlement was at $51.99 a barrel, up 3 cents, on London’s ICE Futures Europe exchange at 11:07 a.m. Singapore time. It declined 18 cents, or 0.3 percent, to end the session at $51.96 a barrel yesterday. The May contract expires today. The more-active June contract was at $52.90 a barrel, down 3 cents, at 11:33 a.m. Singapore time

Pakistan's forex reserves rise to $11.22 bln

The State Bank of Pakistan's reserves rose to $7.86 billion from $7.80 billion a week earlier while reserves held by commercial banks marginally fell to $3.36 billion from $3.37 billion, the bank said.

Pakistan recently received $500 million from the World Bank and $848 million from the International Monetary Fund, which was reflected in the data last week.

Foreign reserves hit a record high of $16.5 billion in October 2007 but fell to $6.6 billion in November last year, largely because of a soaring import bill.

Pakistan agreed in November to an IMF emergency loan package of $7.6 billion to avert a balance of payments crisis.

Economic Calendar

Date

Time

Country

Event

For

Forecast

Actual

Apr 21

12:00 AM ET

RU

Unemployment

Mar

8.5

-

Apr 21

12:30 AM ET

SE

Riksbank rate

8yr

0.25

0.5

Apr 21

1:00 AM ET

IT

Global trade balance

Feb

-

-0.837

Apr 21

1:00 AM ET

IT

Trade balance EU

Feb

-

-0.105

Apr 21

1:30 AM ET

GB

RPI yy

Mar

-0.5

-0.4

Euro up on German investor data, worries remain

The dollar fell against the euro on Tuesday as data showing a sharp improvement in German investor confidence lifted stocks and helped the European common currency rebound from a recent one-month low.

Uncertainty surrounding the European Central Bank's next policy move and an International Monetary Fund report warning that asset writedowns at global banks may exceed $4 trillion limited the euro's gains, though, and kept investors on edge.

In mid-afternoon trade, the euro was up 0.3 percent at $1.2955 after hitting a one-month low of $1.2883 on Monday. Germany's ZEW survey of investor sentiment rose to 13.0 this month from -3.5, the first positive reading since 2007.

The euro also rose 0.7 percent to 127.80 yen , while the dollar added 0.7 percent to 98.65 yen . The yen tends to struggle when investor risk appetite increases, and it's also been hurt by news of Japan's weakening economy.

"We got a euro bounce after ZEW and there's consolidation after a horrible day yesterday in stocks, but my view is this is an opportunity to sell euros," said T.J. Marta, chief market strategist at Marta on the Markets in Scotch Plains, New Jersey.

Analysts said an IMF report that banks worldwide will have to write down assets by $4.1 trillion to restore global stability suggests the financial crisis is far from over, which will boost safe-haven demand for the dollar. For more see[ID:nN21456999].

Euro gains are likely to be limited by uncertainty about what unconventional policy steps, if any, the ECB takes to combat a euro zone recession, analysts said.

The ECB is expected to cut interest rates from 1.25 percent to 1 percent in May, but it's unclear whether it will follow the Federal Reserve and other central banks and create money via other means such as buying corporate or sovereign debt.

Either way, Marta said the euro is likely to suffer. "If the ECB comes together on quantitative easing, the euro will go down because the U.S. has already started," he said. "If they don't, the euro will be punished because the ECB will be accused of not reacting to the crisis."

Quantitative easing is the process of flooding the banking system with money when interest rates are already at or near zero in order to stimulate growth and boost lending.The Bank of Canada on Tuesday cut rates to 0.25 percent, an all-time low, and said it will outline on Thursday its strategy for possible nonconventional measures

Australian Dollar

American Dollar 0.698685 1.43126

Argentine Peso 2.60463 0.383932

Botswana Pula 5.29307 0.188926

Brazilian Real 1.56961 0.637101

Bulgarian Lev 1.05667 0.946369

Canadian Dollar 0.867194 1.15314

Chilean Peso 406.705 0.00245878

Colombian Peso 1629.12 0.000613827

Croatian Kuna 3.98935 0.250668

Estonian Kroon 8.45346 0.118295

Hong Kong Dollar 5.41481 0.184679

Hungarian Forint 162.272 0.0061625

Iceland Krona 90.792 0.0110142

Indian Rupee 35.2644 0.0283572

Iranian Rial 7049.73 0.000141849

Israeli New Shekel 2.94086 0.340037

Japanese Yen 68.5178 0.0145947

Kazakhstani Tenge 105.033 0.00952079

Lithuanian Litas 1.86547 0.536058

Forex Rates window provides real time access to the current Forex rates.

U.S. Dollar Trading (USD) traded higher with US stocks tumbling after negative leads from the Asian and European sessions. Relentless USD buying helped the Euro to crack 1.3000 and dragged the Aussie over 2 cents lower to break through 0.7000. US banks led the market down with profit taking on the recent rally turning into a rout. Bank of America fell 20% while Crude was down 9%. Crude Oil closed down $4.45 ending the New York session at $45.88 per barrel. In US share markets, the Nasdaq was down 64 points or -3.88% whilst the Dow Jones was down 289 points or 3.56%. Looking ahead, Treasury Sec Geithner Speaks and the Bank of Canada releases Interest Rate Statement.

· The Euro (EUR) broke through 1.300 in Asia after Trichet’s comments of the state of the Eurozone economy left a sour taste and risk aversion prompted heavy EUR/JPY selling. The closer to Quantitative easing and the lack of clarity and solidarity within the ECB is taking a toll on the Euro. Overall the EUR/USD traded with a low of 1.2891 and a high of 1.3070 before closing at 1.2930. Looking ahead, April German Zew Survey forecast at -90 vs. -89.4 previously. Also released, German PPI (Mar) forecast at -0.3% vs. -0.5% previously.

· The Japanese Yen (JPY) reclaimed the number one safe haven currency position with USD/JPY easing during the day from above 99 to below 98. The failure to continue gains above 100 and the sharp sell off in equities has cast a heavy shadow on the USD/JPY and most crosses came off hard. CAD/JPY and AUD/JPY were the worst affected with the sharp fall in commodities also weighing on these pairs. Overall the USDJPY traded with a low of 98.54 and a high of 99.59 before closing the day around 99.40 in the New York session. Looking ahead, March Trade Balance forecast at -5Bn vs. 82.4 previously.

· The Sterling (GBP) fell sharply with the Euro early in Asia as concern of over the weekend about the UK government’s debt position and banking worries weighed heavily. Selling continued into Europe after EUR/GBP broke higher and GBP/JPY selling intensified. Overall the GBP/USD traded with a low of 1.4812 and a high of 1.4504 before closing the day at 1.4535 in the New York session. Looking ahead, CPI (Mar) forecast at 0.2% vs. 0.9% previously.

· The Australian Dollar (AUD) fell sharply all day as multiple key support levels were broken. Opening up above 0.7200 was short lived as Asian stocks immediately turned negative prompting traders to take profits and make fresh shorts. AUD/JPY selling led the way lower with the key 70 Yen level breaking in Europe. The US session offered little help with the crash in Oil prices sending the AUD/USD below 0.7000 for the first time since April 2nd. Overall the AUD/USD traded with a low of 0.6956 and a high of 0.7247 before closing the US session at 0.6965. Looking ahead, RBA minutes from the April meeting.

· Gold (XAU) found support as safe haven demand notched higher and slumping banking stocks increased systemic risk in the economy. Overall trading with a low of USD$865 and high of USD$888 before ending the New York session at USD$884 an ounce.

FXCM Holdings LLC has announced its 2008 yearly revenue.

Revenue for 2008 was US$313,628,084 which almost doubled from 2007’s yearly revenue of US$ 175,773,888, an increase of 78%.

These are consolidated results for FXCM Holdings, LLC, which is composed of Forex Trading LLC; Forex Capital Markets LLC; Forex Capital Markets LTD; FXCM Australia LTD; FXCM Asia LTD; and FXCM Canada LTD.

FXCM’s 2008 Milestones:

Total new accounts opened during the year on FXCM’s platforms increased by 66% year-over-year.

Notional USD volume across FXCM’s trading platforms was US$6.8 trillion in 2008.

EBITDA for 2008 was US$131,954,102, an increase of 365% year-over-year.

FXCM expects 2009 to be a year of continued growth as a result of the company increasing its market share, and the sustained growth of the retail forex industry. FXCM believes it will win business by continuing to develop new products based on client segmentation, offering competitive spreads, and regionalizing and expanding its offerings across the globe.

GBP/USD Reaches Next Target In Rally Today

A move back above level again would target the 50% retracement where the 50% , 100 and 200 hour moving average are all located. That level comes in at 1.4767 currently.

Corrections should find support at the 1.4650-56 level with stops if the price moves below 1.4647.

AUD/USD Tests 38.2% Retracement Level

The AUD/USD has been supported today by upbeat comments from RBA Stevens last night. He commented that he sees a clear signs of pick up in China’s economy and that the speed of the global contraction may be abating.

As a result, the AUD/USD has been moving higher despite the fact that the CRB has been down today. A break of the 0.7094 would target the 50% retracement and 100 hour MA at the 0.7140 area.

Japanese Yen: Capped By A Negative Trend Line

Our preference: Short positions below 102.5 with targets @ 96.5 & 93.6 in extension.

Alternative scenario: Above 102.5 look for further upside with 105 & 107.5 as targets.

Comment: the RSI is bearish and called for further decline, the pair should reach its next support.

107.5105102.598.06 (last)96.593.691.6

*USD/JPY Index: the ISE Exchange measures the strength and weakness of the US DOLLAR versus the JAPANESE YEN. For details go to www.ise.com

EUR/USD Rallies, Resulting In Consolidation After Sell-Off

The EUR/USD rallied earlier today (Tuesday), resulting in some consolidation following the large selloff. The strength in the EUR/USD came in reaction to better than expected consumer sentiment data in both Germany and the EU as a whole. However, the rally is losing steam already as the currency pair gives into U.S. equities. Earnings are flooding the U.S. market before the bell, and the results are negative for the most part. Therefore, it seems the positive consumer sentiment numbers won’t be game changing for the EUR/USD.

Investors are more focused on future ECB policy with public discord among its members. Additionally, if U.S. equities lose their footing, investors will likely attach the EUR/USD to the S&P futures since investors believe whatever happens in the U.S. will bleed over into the EU economy due to tight economic coupling. The EUR/USD has already dropped through some key fundamental safety nets. The currency pair is turning its back on the highly psychological 1.30 level, a large victory for the downtrend.

However, as we described in our previous posts, the EUR/USD has some solid supports built up from the condensed trading ranges between February and March. Therefore, even if the near-term selloff should continue, there should be intense battlegrounds from 1.25-1.28. The EUR/USD has found support in our previous 1st tier uptrend line and we created a new 1st tier to show the next uptrend cushion. We maintain our negative stance on the EUR/USD for the time being since the S&P futures look like they have more room to give to the downside. However, the EUR/USD could experience relative strength if U.S. equities proceed to selloff due to the better expected consumer sentiment data.

Fundamentally, we maintain our supports of 1.2919, 1.2876, 1.2833, and 1.2800 with fresh bottom-end of 1.2756. To the topside, our 1.2953 support turns resistance while we hold our resistances of 1.3017, 1.3050, 1.3091, and 1.3126. The 1.30 area still serves as a psychological barrier with 1.25 becoming a key psychological cushion. The EUR/USD is currently exchanging at 1.2927.

European Economics Preview: UK Annual Inflation Forecast To Ease

European Economics Preview: UK Annual Inflation Forecast To Ease

UK consumer prices and German ZEW economic sentiment survey results are due on Tuesday.

At 2.00am ET, the German producer prices report is expected from the Federal Statistical Office. On a yearly basis, producer prices are forecast to rise only 0.1% in March compared to a 0.9% rise in February. From February, producer prices are predicted to drop 0.3%.

The Swedish central bank is scheduled to announce its interest rate decision at 3.30am ET. The Riksbank is expected to cut the interest rate to a record low of 0.5%. The Riksbank is also set to publish how the individual members of the Executive Board voted at the same time as the monetary policy decision is communicated.

Afterwards, the Italian statistical office ISTAT is slated to release February's trade balance at 4.00am ET. The total trade surplus stood at EUR 3.58 billion in January.

At 4.30am ET, the British CPI data is due from Office for National Statistics. Annual inflation is forecast to ease to 2.9% in March from 3.2% in February. Economists expect a month-on-month increase of 0.2%.

After remaining flat in February, UK retail prices are predicted to fall 0.5% in March from the previous year. Excluding mortgage interest payments, retail prices are expected to rise 2.2% annually.

Thereafter, German ZEW survey results are due at 5.00am ET. Economic sentiment in the largest Eurozone economy is seen at 2 in April, reversing a negative reading of 3.5 in March. Meanwhile, the current situation index is forecast to fall to minus 90 in April from minus 89.4 last month

Inches Higher And Remains In Corrective Range

The current price is above the 100 and 200 bar moving average on the 5 minute chart giving a bullish bias intraday. That level comes in at 1.2936 to 1.2943 currently. However, with the price still well below the 100 hour MA at the 1.3070 level, the short term bullish bias is just corrective in nature.

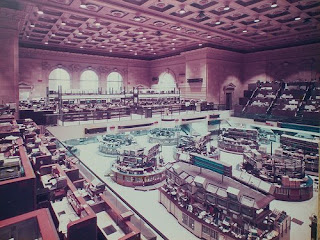

The Old American Stock Exchange

We were in New York City in the summer of 2008. While walking in Little Italy to the Financial District we encountered a construction worker giving away large metal framed photos instead of throwing them in the dumpster. He said they were remodeling an architectural firm and these old photos were from a design the firm did of a stock exchange. The old American Stock Exchange trading floor. Probably in the mid-1980's. It is located at 86 Trinity Place, NY, NY.

Forex history

The Bretton Woods Agreement

In 1967, a Chicago bank refused a college professor by the name of Milton Friedman a loan in pound sterling because he had intended to use the funds to short the British currency. Friedman, ho had perceived sterling to be priced too high against the dollar, wanted to sell the currency, then later buy it back to repay the bank after the currency declined, thus pocketing a quick profit. The bank's refusal to grant the loan was due to the Bretton Woods Agreement, established twenty years earlier, which fixed national currencies against the dollar, and set the dollar at a rate of $35 per ounce of gold

The Bretton Woods Agreement, set up in 1944, aimed at installing international monetary stability by preventing money from fleeing across nations, and restricting speculation in the world currencies Prior to the Agreement, the gold exchange standard--prevailing between 1876 and World War I--dominated the international economic system. Under the gold. exchange, currencies gained a new phase of stability as they were backed by the price of gold. It abolished the age-old practice used by kings and rulers of arbitrarily debasing money and triggering inflation.

But the gold exchange standard didn't lack faults. As an economy strengthened, it would import heavily from abroad until it ran down its gold reserves required to back its money. As a result, money supply would shrink, interest rates rose and economic activity slowed to the extent of recession. Ultimately, prices of goods had hit bottom, appearing attractive to other nations, which would rush into buying sprees that injected the economy with gold until it increased its money supply, and drive down interest rates and recreate wealth into the economy. Such boom-bust patterns prevailed throughout the gold standard until the outbreak of World War I interrupted trade flows and the free movement of gold.

After the Wars, the Bretton Woods Agreement was founded, where participating countries agreed to try and maintain the value of their currency with a narrow margin against the dollar and a corresponding rate of gold as needed. Countries were prohibited from devaluing their currencies to their trade advantage and were only allowed to do so for devaluations of less than 10%. Into the 1950s, the ever-expanding volume of international trade led to massive movements of capital generated by post-war construction. That destabilized foreign exchange rates as set up in Bretton Woods.

The Agreement was finally abandoned in 1971, and the US dollar would no longer be convertible into gold. By 1973, currencies of major industrialized nations became more freely floating, controlled mainly by the forces of supply and demand which acted in the foreign exchange market. Prices were floated daily, with volumes, speed and price volatility all increasing throughout the 1970s, giving rise to new financial instruments, market deregulation and trade liberalization.

In the 1980s, cross-border capital movements accelerated with the advent of computers and technology, extending market continuum through Asian, European and American time zones. Transactions in foreign exchange rocketed from about $70 billion a day in the 1980s, to more than $1.5 trillion a day two decades later.